Insurtech Platform

Transform and grow your insurance business

Manage, distribute, and operate your insurance products seamlessly. Spend less time on admin, and more time growing your business.

Trusted by the leading players in the insurance industry

4.9

Who we help?

Insurers

Launch new products quickly and distribute through an omnichannel approach. All integrated with your digital ecosystem.

MGAs

Gain operational agility, full control over your products, and automate processes with an omnichannel platform.

Finance

Start selling insurance digitally. Embedded insurance products in your app enable your sales force to be more efficient.

Distributors

Sell insurance fully integrated into your sales channel. Boost average order value, customer loyalty, and user experience. Designed for distributors such as digital platforms, eCommerce and large retailers.

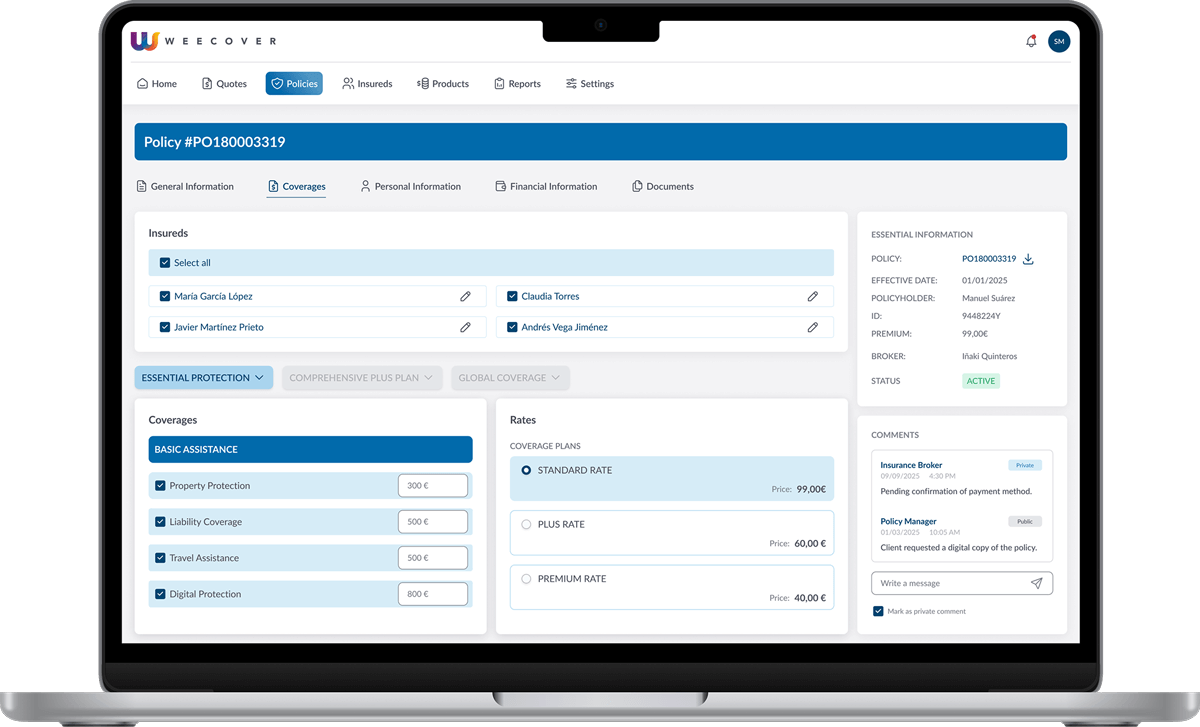

A platform built for the future of insurance

Flexible, scalable, and fully integrable insurtech platform designed for the future of insurance, omnichannel and embedded.

- Real-time quoting

- White-Label

- Omnichanel Distribution

- API-first Architecture

- Multi-product, multi-currency, multi-language

Trusted technology that drives growth in the insurance business

Scalable infrastructure to process high daily policy volumes without interruptions.

Insurers, MGAs, Digital Platforms, Banks, Retailers, and Brokers who trust us to manage their products efficiently.

A product-agnostic platform designed to manage a wide range of insurance products, adapted to different markets, legislations, currencies, channels, and customers.

Average implementation time: from idea to launch in just 4 weeks, accelerating innovation and time-to-market.

Why Weecover for your insurance business?

The leading digital platform for insurance management and distribution. Designed to optimize operations, accelerate time-to-market, and scale your business with flexibility.

Cloud-Native Insurtech

Secure and always accessible.

Modular & Scalable

100% tailored to your business.

API First Integration

Connects seamlessly with your digital ecosystem.

Omnichannel Distribution

Sell insurance online, embedded and offline.

Accelerated Time-to-Market

Launch insurance programs just in 4 weeks

Regulatory Compliance

Fully aligned with current regulations, including DORA and GDPR.

End-to-End Digitalization

Automated processes. From issuance to after-sales.

Data & Reporting

Real-time insights for informed decisions.

Boost your revenue through insurance sales

Distributors, such as digital platforms, eCommerce, and large retailers, sell insurance seamlessly, boosting their revenue with a value-added service that perfectly complements their core product.

What our clients say about us

“Weecover allowed us the absolute flexibility to create exactly the insurance program we were looking for, with a solid technological foundation that other proposals could not offer. The customer doesn’t want trouble, they want something easy, agile, and intuitive; and we have achieved such a natural integration that the user truly feels they are dealing with PcComponentes at all times.”

“They are pioneers in Embedded Insurance, bringing innovation, flexibility, and usability. Their committed and professional team makes complex projects simple, creating real value for both insurers and customers. For us, having them as a partner is a true guarantee of success.”

“With Weecover, we have been able to implement projects quickly and cost-effectively, pilot new ideas with minimal investment, and reach new customers. They are a key partner in our value proposition as an insurer, with a flexible, efficient, and highly professional team.”

“Weecover provides a versatile, well-priced product with a simple process that truly benefits scooter users. Registration and payment are transparent, and the team is always responsive. This insurance is not only useful now but will be essential as it becomes mandatory in Spain.”

FAQs: answers to your main questions

What exactly is Weecover?

Weecover is an End-to-End Insurtech SaaS Platform that serves both functions by providing a single, comprehensive solution for managing and distributing insurance products.

Insurance Core System (Management): It acts as the digital backbone, allowing Insurers and MGAs to configure, manage, and process the entire policy lifecycle (quoting, issuance, administration, collections, and claims integration) with agility.

Omnichannel Distribution Platform: It enables any business that needs to distribute insurance—such as Retailers, or Brokers to seamlessly integrate and sell products across all channels (physical point-of-sale, web, network, partners, call center). This is achieved through simple APIs and Widgets accelerating their Time-to-Market and driving new revenue streams.

Embedded Insurance Solution: The platform is specifically designed to facilitate Embedded Insurance by allowing any partner to integrate insurance products directly into a customer’s purchasing journey or user experience with minimal friction. This ensures relevant coverage is offered precisely when and where it is needed.

In essence, Weecover provides the complete digital engine for insurance management and the omnichannel tools for efficient distribution.

How does Weecover integrate with my current systems (CORE, CRM...)?

Weecover is an API-First platform, designed for seamless integration. You have two main options:

- API (REST): Integrate the platform’s full capabilities (quotation, issuance, management) directly into your existing CORE systems, CRM, or external sales channels using our robust set of APIs.

- Front-end Components: Use our customizable, ready-to-deploy Widgets for a plug-and-play experience. These allow you to embed insurance sales (Embedded Insurance) directly into your website or app quickly, with minimal development effort on your side.

What type of insurance products can I manage / distribute using the platform?

The Weecover platform is 100% product-agnostic, meaning there are no limitations on the types of insurance products you can configure, manage, and distribute.

Our microservices architecture and configuration tools allow you to model and launch virtually any product, regardless of its complexity or specialization. This includes:

- P&C (Property & Casualty): Home, Auto, Liability…

- Specialty Lines: Cyber protection, Pet insurance, and specific micro-insurance products.

- Product Protection: Extended Warranties and insurance linked to retail goods.

- Embedded Insurance: Custom, context-based products for mobility, travel, and financial services.

If you can describe the product, you can configure it, price it, and distribute it using Weecover’s unified platform.

Does the platform manage the full policy lifecycle (quotation, issuance, collections, claims)?

Yes. Weecover is an End-to-End Insurtech Core platform. It provides modules for managing the entire lifecycle:

Quotation and Issuance: Real-time pricing and instant policy generation.

Policy Administration: Endorsements, cancellations, and policy changes.

Collections: Flexible premium payment management.

Claims: Integration and management modules to streamline the claims process.

Does Weecover help me with regulatory compliance?

Yes, absolutely. Weecover is designed with global compliance in mind, adapting to the legal and regulatory framework of the country in question.

Our platform provides the necessary flexibility to ensure your operation is compliant by adapting to:

Local Legislation: The underlying Insurance Core system is built to manage the regulatory requirements of different countries, helping you meet local compliance needs from day one.

Localization: We fully support multiple languages and currencies, allowing you to seamlessly localize your insurance products and user interfaces for new markets.

Weecover’s proven adaptability is demonstrated by its current operations in various international markets, including Spain, Portugal, France, Italy, Mexico, and others. This means you can confidently expand your insurance distribution and management across borders.

Is the platform secure and compliant with data protection regulations?

Yes. Security, resilience, and compliance are core priorities for Weecover, and we adhere to the highest European industry standards.

Security & Data Protection: Our platform is a modern, cloud-native solution built with security principles integrated at every layer. We take compliance with data privacy regulations very seriously, ensuring strict adherence to frameworks like the GDPR (General Data Protection Regulation) for the lawful and secure handling of personal data.

Operational Resilience (DORA): As a key service provider in the financial sector, Weecover is committed to the principles of the DORA (Digital Operational Resilience Act). Our architecture and operational protocols are designed to ensure high resilience, rapid recovery, and continuous service availability, minimizing the impact of potential ICT-related disruptions.

You can be confident that by partnering with Weecover, your operations and customer data will be managed within a technologically advanced environment that is both highly secure and fully compliant with crucial European regulations like GDPR and DORA.

Our latest articles:

Interview with Rafael Gallardo, Digital Director at Weecover

«An insurance program is a living entity that doesn’t end at launch; it must be continuously optimized based on data.» Breaking the barrier between what

Managing General Agents (MGAs): What they are, how they work, and why they are transforming the insurance sector

Managing General Agents (MGAs) have consolidated themselves as a key structural component within the global insurance and reinsurance ecosystem. Although often confused with traditional insurers

Interview with Alberto Altayó, Chief Operating Officer at Weecover

“Our cloud microservices architecture adapts to insurers and MGAs, preserving differentiation with minimal manual intervention.” At Weecover, we are certain that behind every technological advance

Discover Weecover now!

All you need to distribute and manage insurance and scale your business, anywhere.